Is Polysilicium FBR a solution for the French market?

This article is part of the Carbon Footprint series :

- Rapid introduction to the CRE bidding mechanism

- Introduction to Simplified Carbon Footprint: calculation

- LCA and optimized carbon values: method 2 & documentary process

- Impact of the manufacturing country and process: what are the optimization targets?

- Low carbon supply: The Norwegian question

- Low carbon modules: what are the promising alternatives

- Is Polysilicon FBR a solution for the French market?

Facing the turbulence of the polysilicon market, let us focus on the polysilicon produced by the FBR process which seems to us today to be the most suitable solution for supplying the French market with low carbon modules.

The manufacture of polysilicon can be carried out with 3 main purification methods: The Siemens process which is the most widely used covering more than 95% of world production, the FBR process (capacity of 15,000 MT in 2019) and the direct method (Elkem ) (3000 MT capacity).

Polysilicon purification methods by FBR process:

What is the FBR process?

The FBR ou Fluidized Bed Reactor process.

How it works ?

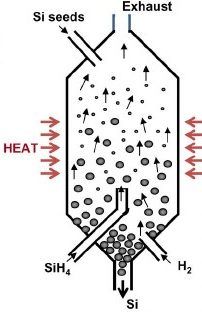

Silicon “seeds” are inserted into a chamber filled with hot, high purity silane gas passing through it.

The gas flow “fluidizes” the silicon seeds which liquefy as the silane gas decomposes and deposits layers of silicon on them: catalytic reaction.

The “seeds” grow larger and heavier and heavier until they leave the chamber when they have reached sufficient size.

History:

- 1970: Texas Instruments attempted to produce polycrystalline silicon granules from TCS using an FBR technique.

- 1970-1985: The JPL and UCC FBR program explored the challenges posed by the other feature of thermal decomposition of silane (ended in the mid-1980s).

- Mid-1980s: Ethyl Corp (now SunEdison) successfully commercialized a silane-based RBF at its plant in Pasadena, Texas.

- 1990: Ethyl’s silane / FBR unit is sold to Albemarle and then taken over by MEMC.

- 1992: UCC sold its silicon business to KEM, which ranemed the silane – silicon business ASiMI. ASiMI relaunched the FBR program in 1996 with funding for new owners.

- 2002: REC purchased 50% of the Moses Lake facility from ASiMI and changed the focus of RBF to “solar” silicon. The FBR then became a metal (FBR-A).

- 2009: REC marketed the FBR-A polysilicon.

- 2010: MEMC / SunEdison and Samsung signed a memorandum of understanding to form a polycrystalline silicon joint venture in South Korea’s SMP cellular.

- 2012: GCL announced that it had successfully completed high purity silane gas production trials. This was the first step towards the production of polysilicon using the RBF method.

- 2014: REC Silicon announced a new JV with Shaanxi Tian Hong to build its second FBR project.

- 2017: GCL-Poly bought its FBR silicon production assets from SunEdison.

The characteristics and advantages of the FBR process:

- Process: The FBR polysilicon production process is a linear (continuous) process unlike the Siemens method which involves production batches (shutdown and restart of reactors).

- Raw material: Silane

- Energy: Low energy consumption. The FBR process consumes on average only 12 kWh per kg produced compared to 60 kWh / kg for Siemens polysilicon.

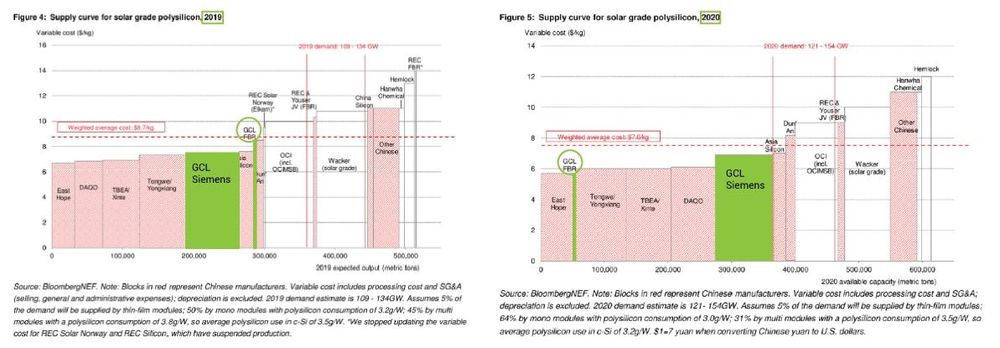

- Production cost: The optimizations of the manufacturing process and its deployment on a larger scale now allow to come close the production costs of Siemens *. The improvement will continue with the extension of production capacities planned for 2020 (GCL plans to expand its FBR capacity to 10,000 MT at the end of 2020 and to 30,000 MT at the end of 2021).

* 8.5 $ / kg = estimated cost GCL FBR – Source Bloomberg NEF 2019

Challenges

To guarantee the competitiveness of this process, it was necessary:

- Go from pilot production to industrial production. This was a big challenge because fluid dynamics change on a larger scale.

- Solve the problems of metallic contamination of reactor walls which would impact the quality of the polysilicon obtained.

- Reduce the amount of polysilicon dust because it can hardly be used by ingot producers.

- Produce polysilicon with sufficient purity for mono and monocrystalline cast ingots.

The challenges: To simultaneously increase the capacities and the purity of the material obtained.

Other methods of polysilicon purification:

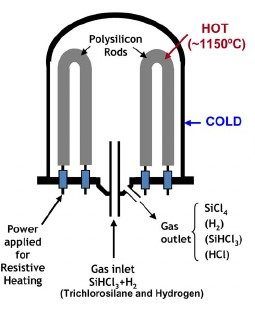

The Siemens process

- Process: Batch or loop production process. The silicon recovery method requires reactors to be switched off and back on between each batch.

- Raw materials: Trichlorosilane and hydrogen

- Energy: Very consuming silicon deposition process in reactors (CVD). Consumption of 60 kWh / kg. Its carbon footprint note is therefore higher.

- Production cost: Between $ 7 and $ 8 / kg.

Direct metallurgical process:

This alternative method developed by ELKEM (now REC Solar Norway) was strongly acclaimed by French calls for tenders. It has a low carbon impact thanks to its low electricity consumption and its Norwegian production. However, its limited capacity and high cost are probably part of the reason why the production ended in July 2019.

We have already mentioned this process and its limits for the CRE calls for tenders market in our article: CARBON FOOTPRINT & FRENCH PV TENDERS – Low carbon supply: The Norwegian question

The polysilicon market, a market subject to turbulence:

The trade war in polysilicon production at the end of 2017 (“Rec silicon sees 38 % sales increase in q3 “) has settled down:

Chinese manufacturers have often relocated their production capacities in the west of the country, which offers lower electricity costs. Thus, the cost of Chinese polysilicon dropped from $ 13 / kg in 2017 to an average production cost below $ 8.7 / kg in 2019 (see table fig4 above).

Faced with cost pressure, many manufacturers have stopped their production:

Indeed, just like REC Solar Norway (Elkem process) which had ended its production in July 2019, REC Silicon in Moses Lake followed the same path (“Rec silicon prepared to power down the rest of its operation”). As for OCI, they announced the suspension of their production in February 20 (“S. Korean top polysilicon maker OCI to close domestic production” see also: “Is this the end for Korean polysilicon?”).

” The dynamic of CRE tenders motivates us to constantly seek the most efficient, innovative and least impactful products.

This is why we have been investing for 3 years in the forward-looking technology of FBR process.

It has the advantages of competitiveness, low carbon impact and the purity of the material and opens the door to industrial breakthrough, particularly in ingot process improvement.”