PV module cost breakage – What to expect in the coming months?

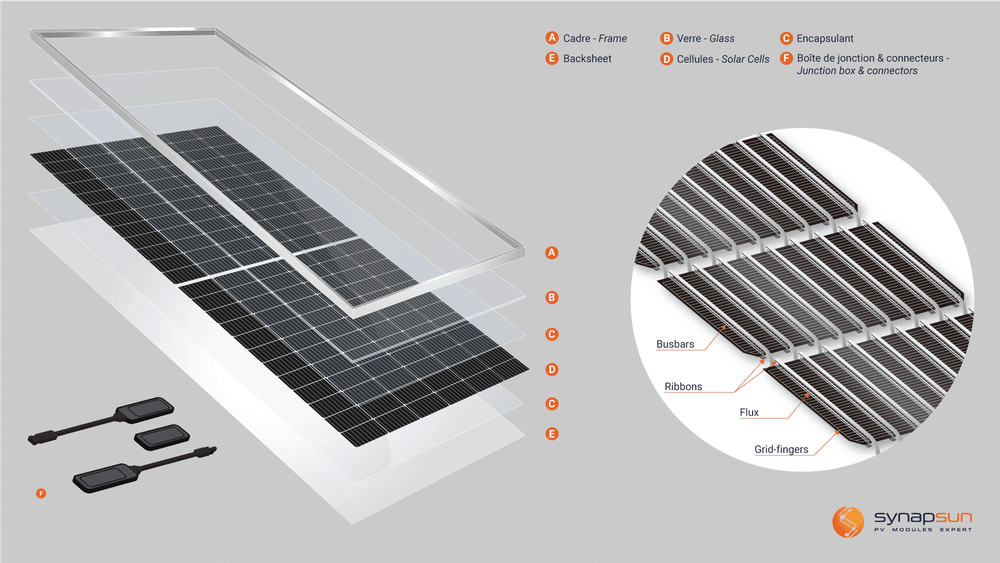

Composition of a PV module:

Most of you will know that a PV panel is made of connected cells with metals, of glass, plastic, and an aluminium frame for mechanical resistance and mounting. Actually, there are a lot more materials.

The cells represent only a bit more than 7% of the total weight. They are mostly made of monocrystalline silicon wafers since 2020. The wafer is doped and textured to collect as much energy light as possible. A metallic pattern (grid-fingers & busbars) of silver and aluminium paste is printed on both sides of the cell to collect and conduct the generated current. Same for ribbons (copper, tin, and lead) which are soldered with flux and connect the cells with each other.

After that, they are laminated between backsheet and glass by using a plastic encapsulant (EVA “Ethylene-Vinyl Acetate” or POE “Polyolefin Elastomer”). The backsheet can be made entirely of PET but sometimes they include a fluoropolymer layer (PVF, PVDF…) to increase its chemical resistance. An aluminium frame then ensures mechanical resistance of the whole laminate. A junction box with cables and connectors finalizes the module, so the modules can be interconnected.

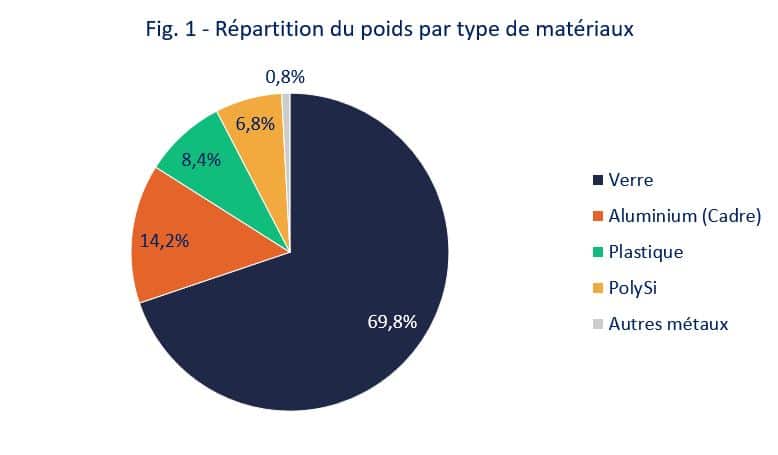

See below the weight repartition of the materials in a standard glass-backsheet PV module.

PV module costs mainly driven by material and energy prices:

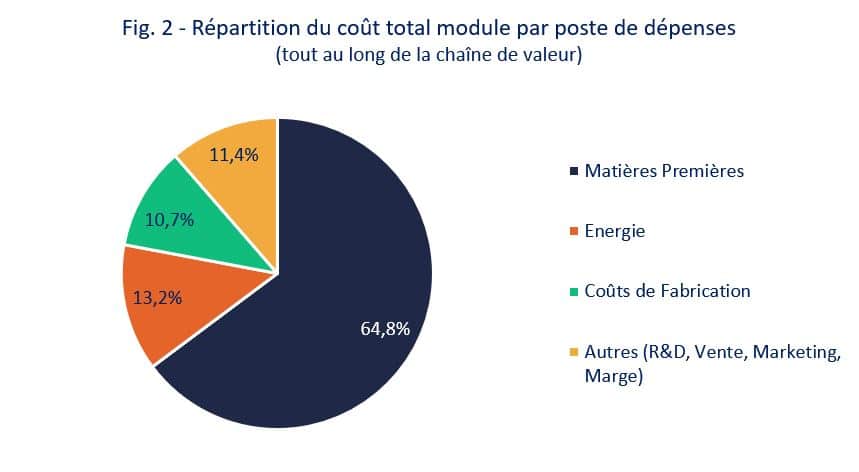

Raw material prices are the most impacting factor of PV module costs. However, they are changing every day. Most manufacturers have contracts with a run-time of up to one month. So, they are mainly dependent on spot prices. Raw material prices fluctuate with different events all around the globe and change strongly with supply and demand.

The second most impacting factor is energy which represents around 14% of the total cost and even more as the energy for Polysilicon, Ingot and Wafer and other materials production is already included in raw material costs calculation.

Polysilicon, Aluminium, Silver & Glass: key materials.

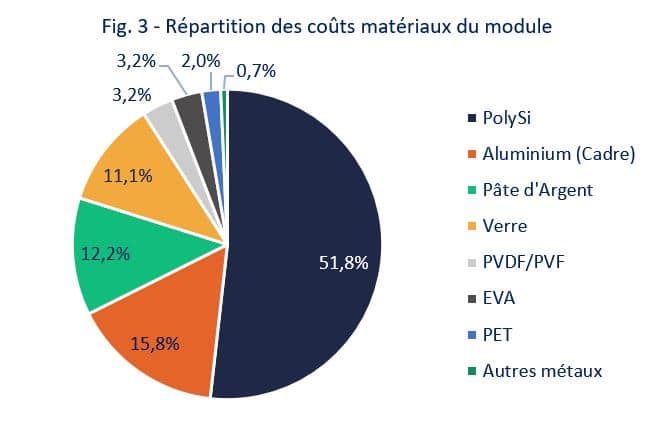

Raw material costs of modules are mainly driven by the polysilicon price. Same for the aluminium frame and silver paste which depend on the corresponding metals spot price. Most raw material spot prices skyrocketed in the past months mainly due to the COVID-19 pandemic which disorganized the supply chain all around the globe. Logically, this increases PV module costs.

Although polysilicon has just a mass fraction of 7% of the modules total weight, it is responsible for 52% of the total raw material costs. That is why, manufacturers continue to optimize their product design and try to use less of these key materials. Decreasing wafer thicknesses, new cell designs, and process upgrades enable a reduction of silver paste consumption, the frame design is optimized to consume less aluminium, the glass thickness is being reduced…

What has been the real impact of Materials spot-price on module cost?

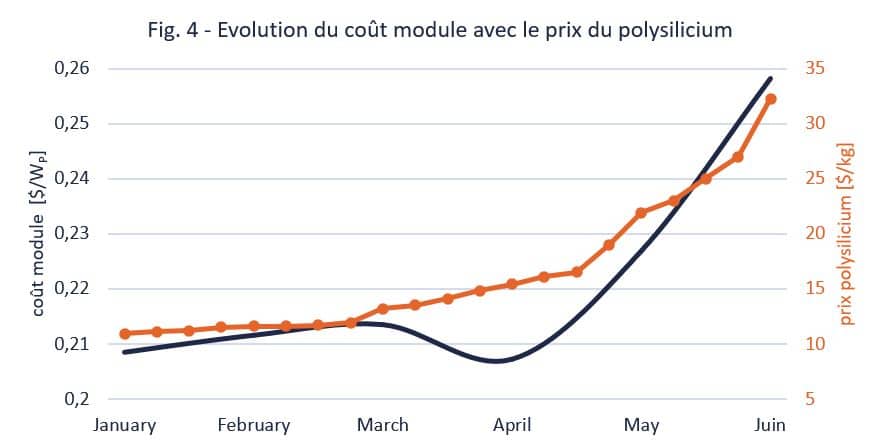

Significant event, the polysilicon spot-price has almost doubled since the beginning of the year. Figure 4 shows the variation of module costs along with the fluctuation of the polysilicon price and other materials from the beginning of this year. Due to price decreases of silver and glass in April, the total costs decreased, too.

Sea Freight prices are going crazy!

For this analysis, the costs all the along the PV manufacturing value chain of the PV module have been considered, from polysilicon production to the module ready to be shipped (See Calculations Assumptions and Sources at the end of the article).

Transportation by sea, if we consider a module manufactured in China, is also very impactive on final cost of a module shipped to Europe. Indeed, sea freight prices were going crazy during the last semester due to the global situation and specific events like the ship that blocked the Suez-canal for example. A container from Shanghai to Rotterdam costs up to $10 000 these days compared to $2 000 in H2 2020.

What to expect in the next months?

The PV industry was mainly driven by falling prices across the supply chain during the last years. Raw material prices stayed stable. Manufacturers managed to increase the efficiency of their products. At the same time, they used less and less material while optimizing the manufacturing process.

We are in a different situation nowadays. Most raw materials spot prices increased strongly since the end of 2019. The polysilicon price rose 80 % in just three months. This trend is expected to continue, and the spot price may reach $35/kg by the end of summer. New capacity will come online later this year, and the price will fall again. Other raw material prices like silver or glass spot prices arrived already at their pre-pandemic level.

If the sea freight is not decreasing and the supply is not catching up with the global demand, module prices will stay on a high level in Europe. Some projects in Europe may not be rentable anymore, which will result in less new solar PV capacity.

Calculation assumptions:

The presented module costs are calculated with a downstream supply chain analysis (Polysilicon. Ingot, Wafer, Cells, Modules manufacturing steps based in China). The modelled module has 144 monocrystalline M8 (166 x 166mm) p-type PERC half-cells. This result in a module nominal power of 460 Wp.

The material quantities are based on module and cell-sizes. Most of the assumptions can be found in the sources. The costs for production equipment and facilities come from annual reports of global leading manufacturers.

Source :

- SPOT PRICE_Solar | InfoLink (infolink-group.com)

- London Metal Exchange

- Solar EVA Global Database | ENF Photovoltaic Directory (enfsolar.com)

- National Survey Report of PV Power Applications in China (iea-pvps.org)

- Multi-Grade Polysilicon today | Minor Metals | SMM – China Metal Market

- Crystalline Silicon Photovoltaic Module Manufacturing Costs and Sustainable Pricing : 1H 2018 Benchmark and Cost Reduction Road Map

- IEA PVPS report – Trends in Photovoltaic Applications 2019 (iea-pvps.org)

- IEA PVPS report – Trends in Photovoltaic Applications 2020 (iea-pvps.org)

- Yahoo Finance